FAQs: First Installment Property Tax Bills

⇨ Looking for assistance for your Tax Year 2019 second installment property tax bill issued in June, 2020? Please go here: https://www.cookcountyassessor.com/property-tax-assistance

Do you have questions about your first installment property tax bill for the 2019 tax year? All first installment bills are, by law, 55% of the total taxes paid the previous year.

Any changes in property assessments from the previous year, and all exemptions, will appear on the second installment bills calculated this summer.

Property Tax-Saving Exemptions for Homeowners

- I had an exemption last year. Do I need to re-apply?

- How can I apply for exemptions?

- What are common reasons exemption applications are denied?

- I applied for an exemption online. How do I check its status?

- I qualified for a Homestead Exemption for Tax Year 2019, but I didn’t apply / my application was not completed before the deadline. What will happen?

Property information and corrections

- I do not know my Property Index Number (P.I.N.). How can I obtain it?

- My parcel has not been assigned its own PIN yet. How do I pay my tax bill by legal description?

- How do I get my property location corrected?

- My name and/or mailing address is wrong on my tax bill. How do I get this corrected?

- I need to verify ownership of a piece of property, if it has foreclosed, or if there has been a lien. What office should I call?

Property assessment and appeals

- What actions are being taken about COVID-19 and property assessments?

- How can I compare my home's assessment to comparable homes?

- When and how can I file an appeal of my property's assessed value?

- My township is open for appeals, but when I click "Submit" on my appeal, there's an error.

- How can I check the status of my online appeal?

I had an exemption last year. Do I need to re-apply? If so, how?

If you received the Homeowner and/or Senior Exemptions last year and your residency did not change, you will automatically continue to receive both the Homeowner and Senior Exemptions and do not need to re-apply. Note: A new law this year allows for the automatic renewal of the Senior Exemption for those taxpayers who received it last year. All other exemptions besides the Homeowner and Senior Exemptions require annual applications.

If you received the Senior Freeze Exemption last year, the Cook County Assessor's Office mailed your renewal application to your home in January.

If you received the Persons with Disabilities, Veterans with Disabilities, and/or Longtime Occupant Exemptions, we mailed your renewal application to your home in February.

How can I apply for exemptions for the first time?

Note: the deadline to apply for exemptions for Tax Year 2019 was April 10, 2020.

New homeowners: If you purchased your home between January 2, 2018 and January 1, 2019, the Cook County Assessor's Office will mail exemption application forms directly to your home in February.

Exemption applications for the 2019 tax year (billed in 2020) are available online for the Homeowner, Senior, Senior Freeze, Persons with Disabilities, Veterans with Disabilities, and Returning Veterans Exemptions.

There is also a Long Time Occupant Exemption. Fewer than 2% of homes qualify for this exemption, so the Cook County Assessor's Office sends application forms directly to these homes whose assessments have increased to meet statutory requirements to qualify for this exemption.

Read more on the exemptions page.

Taxpayers eligible for prior year exemptions may apply for up to three years of Certificates of Error/refunds for missing exemptions. Read more about this process.

What are common reasons exemption applications are denied?

For every exemption, the Illinois Property Tax Code defines what qualifications must be met by the applicant and by the home to be eligible for an exemption. When an exemption application is submitted, Cook County Assessor's Office staff use information on the application as well as supporting documents, such as ID, to verify eligibility. It can take 60-90 days for our staff to process an exemption application and documents in our system.

Below are some common, avoidable reasons that exemption applications are denied:

- the application was submitted without an ID

- the ID submitted is expired and invalid

- Need proof of residency, or Occupancy Affidavit

- Invalid PIN number

- Commercial PIN was submitted (only residential properties apply)

- the home purchase was after January 1, 2019.

- This home does not qualify for tax year 2019, but would qualify for tax year 2020 (applications accepted next year)

I applied for an exemption online. How do I check its status?

If you submitted an Exemption application online, you can take the following steps to check its status.

- Log in to this website using the account you used for your application:

https://app.docusign.com/documents

- This will show the status of each of your exemption applications.

The Status will tell you if you have not completed it yet (Need to Sign), if it is in progress with our Office (Waiting for Signers), or completed (Accepted or Declined).

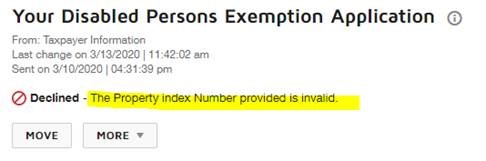

- If your Application’s status is “Declined,” you can click on the application to see more information.

As an example, one common reason for a declined application is that an invalid PIN was provided. This applicant could use our website to double check their home’s PIN (https://www.cookcountyassessor.com/address-search), and then re-apply online.

Please note: It can take 60-90 days for Cook County Assessor’s Office staff to review and process your application and documents. You will then receive an email about whether your exemption application has been approved or denied.

If your exemption application is approved, the exemption will be applied by the Treasurer to the second installment property tax bill you receive in the summer.

Why does it take so long? Our staff carefully review the eligibility of the applicant and the home, and documentation provided, to ensure that statutory eligibility requirements are met. If an exemption is granted erroneously, it can result in back taxes and a lien on the property.

I qualified for a Homestead Exemption for Tax Year 2019, but I didn’t apply / my application was not completed before the deadline. What will happen?

Your second-installment property tax bill you receive this summer will be calculated for Tax Year 2019. However, once you receive the bill, the Assessor’s Office can assist you in obtaining an adjusted bill or a refund for any exemption for which you qualified.

To receive an adjusted bill or a refund, you will need to apply for the exemption, including supplying documents to prove eligibility, using the Certificate of Error process.

Applications for Tax Year 2019 cannot be accepted until after Tax Year 2019 second-installment bills are received. We encourage you to review the forms and documents required now, and ask us questions so that we can help you prepare your application in a timely manner and submit it later this summer when applications are accepted.

Learn more here: https://www.cookcountyassessor.com/certificates-error

Note: Certificate of Error applications for Tax Years 2016, 2017, and 2018 are being accepted if you did not receive an exemption for which you were eligible. These applications are online at the above link.

I do not know my Property Index Number (PIN). How can I obtain it?

You may locate your property index number on the following:

- your tax bill,

- your property deed,

- your closing documents from the purchase of your home,

- your reassessment notice,

- notices from the Assessor's Office if the underlying parcel has been divided, (i.e condominiums, new subdivisions)

You may also visit the Assessor's website to search for your PIN by typing in your address on the property address search page. Input your house number (omitting the box that states house range), include your street name, your city, and hit search.

My parcel has not been assigned its own PIN yet. How do I pay my tax bill by legal description?

Often, shortly after a property is developed or re-developed, individual parcels are not readily assigned their own property index numbers. The developer may have requested to divide the property into individual PIN(S) but his or her request may still be pending approval.

In such cases, each owner is responsible for timely payment of his or her portion of taxes but need not pay the entire tax bill for the full property. The process for making such payments is commonly referred to as "payment by legal description." Through this process, individual owners pay the taxes only for the portion of the property, they own and this protects their ownership rights even if the other owners of the other portions of the same PIN fail to pay. Property owners who need to pay real estate taxes by legal description must make a formal request with the Cook County Assessor's Office at 312-603-6526.The Assessment by Legal Application may also be found on the assessor's website here.

How do I get my property location corrected?

To change a property's location, please download a property location correction form from our website. The form is listed under the "forms" section on our website in the sub area named "miscellaneous." After submitting that form to the Cook County Assessor's Office, the property's location can be corrected.

This is the link to download the form.

The mailing address is listed in the upper right hand corner of the form.

My name and/or mailing address is wrong on my tax bill. How do I get this corrected?

Property tax bills are mailed and collected by the Cook County Treasurer. To change a name or a mailing address on a bill, you must contact the Cook County Treasurer's Office at 312-443-5100. You can also correct this online at www.cookcountytreasurer.com

I need to verify ownership of a piece of property, if it has foreclosed, or if there has been a lien. What office should I call?

To verify ownership of a piece of property, if a property has foreclosed, or if there is a lien on a property, you must contact the Cook County Recorder of Deeds Office at 312-603-5050. You may also be able to verify ownership online using their website: https://cookrecorder.com/

What actions are being taken about COVID-19 and property assessments?

We are doing all we can in our office to ensure our assessments reflect any effects of COVID-19. South Suburban reassessments scheduled for this year will be adjusted to reflect estimated effects of this outbreak on property values.

Read the report on adjustments to residential and commercial properties in the south and west suburbs at https://www.cookcountyassessor.com/covid19

Property owners whose properties are not normally reassessed this year – in the North Suburbs and Chicago – will also receive information about adjusted assessed values later in the year after appeals have been processed.

Any adjustments to property values will affect 2nd installment tax bills issued in 2021.

The Cook County Assessor’s Office has no legal authority to delay, suspend, or freeze property tax bills.

How can I compare my home's assessment to comparable homes?

Homes that are comparable (similar) to each other should have similar market values, and therefore similar assessed values. One way to evaluate whether your home has been assessed fairly, or uniformly, is to compare its assessment to the assessment of other comparable homes.

- What are Comparable Properties?

- Find Comparable Properties (including how to submit up to PINs of up to 6 comparable properties with an appeal)

When and how can I file an appeal of my property's assessed value?

You can file an appeal but only if your township is currently open for appeals. Please check the Reassessment Calendar and Deadlines.

In 2020, the Cook County Assessor's Office greatly expanded the ways that property owners can appeal online. Our new online system allows filers to start a draft filing and save it to revise later, and attach documents. Please note: currently, Update: As of March 16, 2020, the office will be closed to the public. Practitioners who file appeals representing property owners will be required to file appeals online only.

Note the mailing of assessment notices and all appeal deadlines have been suspended until further notice due to unexpected changes in Assessor’s Office operations brought on by the COVID-19 outbreak. Updates to this schedule will be announced via CCAO email newsletter. Please sign up here for updates.

You receive a reassessment notice notifying you of any changes in the assessed value of your property the year before any changes are reflected on your second-installment tax bill. That is the best time to appeal your assessment.

Any change in assessment (whether due to a reassessment or an appeal) in 2020 will not be reflected until your second-installment 2020 tax bill, which is sent next year in 2021.

All first installment bills are, by law, 55% of the total taxes paid the previous year. Any changes in assessment from the previous year, and all exemptions, appear on second installment bills sent in the summer.

My township is open for appeals, but when I click "Submit" on my appeal, there's an error.

The CCAO has extended the deadline for appeals for many townships. Because of the way that the online system processes file numbers and deadlines, you may encounter an error when you try to submit your filing. To correct this problem, please do not file this appeal. Instead, please:

- Ensure that the settings on your phone or computer you are using to file your appeal is set to Central Time. Then,

- start your appeal filing over from the beginning.

We apologize for the inconvenience.

Appeals that have been submitted are being processed and should not be re-submitted.

How can I check the status of my online appeal?

To check on the status of your appeal:

- Go to https://propertytaxfilings.cookcountyil.gov/

- Log in.

- Click on My Filings.

- You will be able to review your appeal information.

For questions and information about appeals, including how to file and find information about your property or other properties, please send us a message via the General Contact page on our website.

For specific questions regarding errors using the online system, email onlineappeals@cookcountyassessor.com.

All first installment bills are, by law, 55% of the total taxes paid the previous year. Any changes in assessment from the previous year, and all exemptions, appear on second installment bills sent in the summer.

What are the Assessor's Office locations?

The Cook County Assessor’s Office has closed its downtown and suburban branch offices until further notice to safeguard the health of both its staff and the public. You can continue to access services and assistance: https://www.cookcountyassessor.com/access-ccao-online

We have been working to develop online resources, including graphics and videos, to ensure property owners have the tools they need to receive service during this time. We also have limited staff working remotely to answer your questions and inquiries. Processing of your forms and applications will be delayed during this extraordinary time. We will continue to keep the public informed via our email and social media channels. Thank you for your patience.

Downtown Office

118 N. Clark Street

Room 320 Chicago, IL 60602

312-443-7550

Bridgeview Branch Office

10200 South 76th Avenue

Room #237

Bridgeview, IL 60455

708-974-6451

Markham Branch Office

16501 S. Kedzie Ave.

Markham, IL 60426

708-232-4100

Skokie Branch Office

5600 W. Old Orchard Rd.

Room #149

Skokie, IL 60077

Phone: 847-470-7237

Enter PIN to see property details

Don’t know your PIN? Search by address here.